Page 8 - 2022 Popular Annual Financial Report

P. 8

general fund

REVENUES

The General Fund is used to account for all financial resources of

the City traditionally associated with government operations that

are not required legally or by sound financial management to be

accounted for in another fund.

The City of Moreno Valley strives to provide our citizens with the

very best value for their dollars while offering the level of services

our Citizens deserve. The Financial and Management Services

department is committed to exceeding these expectations while

ensuring the long-term financial stability and sustainability of the

City government. The City’s fiscal year is July 1 through June 30.

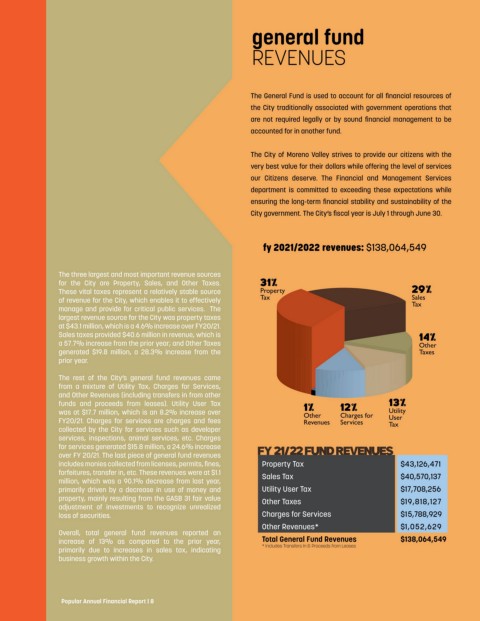

fy 2021/2022 revenues: $138,064,549

The three largest and most important revenue sources

for the City are Property, Sales, and Other Taxes. 31%

These vital taxes represent a relatively stable source Property 29%

of revenue for the City, which enables it to effectively Tax Sales

manage and provide for critical public services. The Tax

largest revenue source for the City was property taxes

at $43.1 million, which is a 4.6% increase over FY20/21.

Sales taxes provided $40.6 million in revenue, which is 14%

a 57.7% increase from the prior year; and Other Taxes Other

generated $19.8 million, a 28.3% increase from the Taxes

prior year.

The rest of the City’s general fund revenues came

from a mixture of Utility Tax, Charges for Services,

and Other Revenues (including transfers in from other

funds and proceeds from leases). Utility User Tax 1% 12% 13%

was at $17.7 million, which is an 8.2% increase over Other Charges for Utility

FY20/21. Charges for services are charges and fees Revenues Services User

Tax

collected by the City for services such as developer

services, inspections, animal services, etc. Charges

for services generated $15.8 million, a 24.6% increase FY 21/22 FUND REVENUES

over FY 20/21. The last piece of general fund revenues

includes monies collected from licenses, permits, fines, Property Tax $43,126,471

forfeitures, transfer in, etc. These revenues were at $1.1 Sales Tax $40,570,137

million, which was a 90.1% decrease from last year,

primarily driven by a decrease in use of money and Utility User Tax $17,708,256

property, mainly resulting from the GASB 31 fair value Other Taxes $19,818,127

adjustment of investments to recognize unrealized

loss of securities. Charges for Services $15,788,929

Other Revenues* $1,052,629

Overall, total general fund revenues reported an

increase of 13% as compared to the prior year, Total General Fund Revenues $138,064,549

primarily due to increases in sales tax, indicating * Includes Transfers In & Proceeds from Leases

business growth within the City.

Popular Annual Financial Report | 8