Page 27 - 2018-2019 MVUAnnual Report

P. 27

CITY OF MORENO VALLEY, CA

Notes to Financial Statements

YEAR ENDED JUNE 30, 2019

NOTE 5

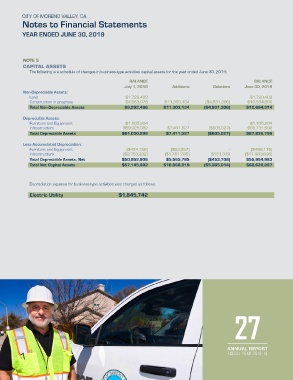

CAPITAL ASSETS

The following is a schedule of changes in business-type activities capital assets for the year ended June 30, 2019:

BALANCE BALANCE

July 1, 2018 Additions Deletions June 30, 2019

Non-Depreciable Assets:

Land $1,729,408 - - $1,729,408

Construction in progress $4,563,078 $11,303,134 ($4,931,306) $10,934,906

Total Non-Depreciable Assets $6,292,486 $11,303,134 ($4,931,306) $12,664,314

Depreciable Assets:

Furniture and Equipment $1,105,204 - - $1,105,204

Infrastructure $59,925,092 $7,411,527 ($605,027) $66,731,592

Total Depreciable Assets $61,030,296 $7,411,527 ($605,027) $67,836,796

Less Accumulated Depreciation:

Furniture and Equipment ($424,158) ($63,957) - ($488,115)

Infrastructure ($9,753,232) ($1,781,785) $151,319 ($11,383,698)

Total Depreciable Assets, Net $50,852,906 $5,565,785 ($453,708) $55,964,983

Total Net Capital Assets $57,145,392 $16,868,919 ($5,385,014) $68,629,297

Depreciation expense for business-type activities was charged as follows:

Electric Utility $1,845,742

27

ANNUAL REPORT

FISCAL YEAR 2018-19